Labels:

Health Sector Management

,

MBA

Why?

Some readers have asked the purpose of such an analysis. Here are my reasons:

1) Health care is a relatively new industry that consistently recruits MBAs. Because of this, brand recognition for MBA schools in this sector is just forming. There is really not much out there in terms of school recruiting performance so this is a start.

2) When engaging with prospective students, I often get asked how strong the HSM program is. The only data I really have is that we're the largest program in terms of body count. Other than that, I didn't have any objective data to give folks a comparison. We know from Fuqua professor Dan Ariely's work that relativity is important to human decision making, so I thought I'd find some data to help prospective students out.

What I did

I took a look at top 20 programs that were known for health care or had significant recruiting numbers for the industry. I then went on to each program's website and analyzed publicly available employment data to draw some comparisons between schools. Initially I wanted to look at biotech and pharma stats only, but very few schools offered that level of detail, so the following data is for all health care companies. Here's a rough look at the health care employment results between leading US MBA programs.

Results

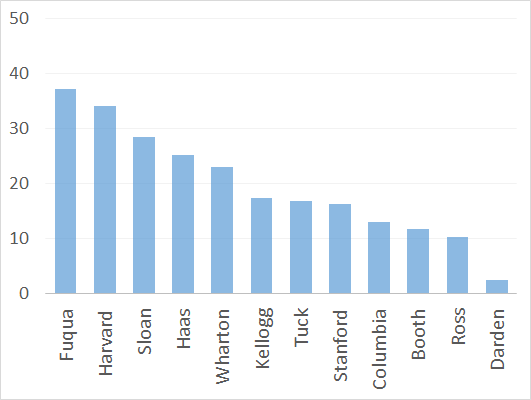

1. Fuqua, Harvard, Wharton, Sloan, Haas take the lead in absolute numbers that were hired to health care companies.

Looking at only data from the 3 classes graduating in 2011, 2012, 2013, I calculated an estimate of the absolute numbers of MBA grads who were hired into health care companies. There are some issues with the data as each school reports their data slightly differently (see the methods section below for details on the original data).

2. On average, the 12 US business schools in this sample have 20 students per year hired into health care companies, or 5% of their class - each year.

3. From 2011-2013, Fuqua leads in total percentage of its MBA class hired into health care companies with 10%, followed by Haas and Sloan with 8% and 7%, respectively.

Methods

Each year schools publish employment data and make them available on their websites. Most schools publish as percentages. I converted this to absolute numbers as it's hard to compare between schools since each program and year has a different class size. I assumed that the programs' hire percentage was # hired over # of students actively seeking jobs. A couple of caveats to this approach:

1. Employment data appears to be self-reported, so the absolute numbers will be only a ballpark figure. This post should only be used to get a rough comparison of programs and not as an absolute analysis.

2. It is unclear for some schools how they calculated their percentages, so I assumed all of the denominators are # of students actively seeking jobs, and not total students. Some schools do this differently (for example for some years Columbia included sponsored students in their %'s) but I tried my best to be consistent.

3. For Tuck, Haas, and Sloan I used 2013 internship data, as at the time of writing (Winter 2013) that was the only data available. I may update this later to include full time data.

4. Does not include consulting or banking positions that focus on health care. Instead, these data points are typically contained in consulting and banking categories for schools.

Health Care Employment Stats for Leading MBA Programs

Posted by

Steven Ma

on

July 16, 2014

One helpful factor to consider when choosing which MBA program to apply to are the employment statistics. While almost all MBA programs have solid consulting and banking employment numbers, health care results are less consistent across schools.Why?

Some readers have asked the purpose of such an analysis. Here are my reasons:

1) Health care is a relatively new industry that consistently recruits MBAs. Because of this, brand recognition for MBA schools in this sector is just forming. There is really not much out there in terms of school recruiting performance so this is a start.

2) When engaging with prospective students, I often get asked how strong the HSM program is. The only data I really have is that we're the largest program in terms of body count. Other than that, I didn't have any objective data to give folks a comparison. We know from Fuqua professor Dan Ariely's work that relativity is important to human decision making, so I thought I'd find some data to help prospective students out.

What I did

I took a look at top 20 programs that were known for health care or had significant recruiting numbers for the industry. I then went on to each program's website and analyzed publicly available employment data to draw some comparisons between schools. Initially I wanted to look at biotech and pharma stats only, but very few schools offered that level of detail, so the following data is for all health care companies. Here's a rough look at the health care employment results between leading US MBA programs.

Results

1. Fuqua, Harvard, Wharton, Sloan, Haas take the lead in absolute numbers that were hired to health care companies.

Looking at only data from the 3 classes graduating in 2011, 2012, 2013, I calculated an estimate of the absolute numbers of MBA grads who were hired into health care companies. There are some issues with the data as each school reports their data slightly differently (see the methods section below for details on the original data).

2011

|

| The absolute number of students hired into health care positions in the Class of 2011 |

2012

|

| The absolute number of students hired into health care positions in the Class of 2012 |

2013

|

| The absolute number of students hired into health care positions in the Class of 2013 |

2. On average, the 12 US business schools in this sample have 20 students per year hired into health care companies, or 5% of their class - each year.

3. From 2011-2013, Fuqua leads in total percentage of its MBA class hired into health care companies with 10%, followed by Haas and Sloan with 8% and 7%, respectively.

|

| Fuqua leads in terms of percentage of graduates hired into health care positions (3 years data combined) |

Methods

Each year schools publish employment data and make them available on their websites. Most schools publish as percentages. I converted this to absolute numbers as it's hard to compare between schools since each program and year has a different class size. I assumed that the programs' hire percentage was # hired over # of students actively seeking jobs. A couple of caveats to this approach:

1. Employment data appears to be self-reported, so the absolute numbers will be only a ballpark figure. This post should only be used to get a rough comparison of programs and not as an absolute analysis.

2. It is unclear for some schools how they calculated their percentages, so I assumed all of the denominators are # of students actively seeking jobs, and not total students. Some schools do this differently (for example for some years Columbia included sponsored students in their %'s) but I tried my best to be consistent.

3. For Tuck, Haas, and Sloan I used 2013 internship data, as at the time of writing (Winter 2013) that was the only data available. I may update this later to include full time data.

4. Does not include consulting or banking positions that focus on health care. Instead, these data points are typically contained in consulting and banking categories for schools.

Would love to hear people's thoughts in the comment section below!

Subscribe to:

Post Comments

(

Atom

)

Nice analysis!

ReplyDeleteThank you!

DeleteThis is good research. But what do you mean when you say that MBAs for the health care industry is quite new?

ReplyDeleteThanks for the comment. Traditionally, MBA programs were pipelines to fill the consulting and banking industries. Nowadays, MBAs are pursuing many alternative career paths. The health care sector is one that has recently been increasingly recruiting MBAs. For example, hospitals are now seeking MBAs in their leadership programs as the market is rapidly evolving. These positions were traditionally filled with MHAs or MDs. Many pharma and med device companies now have leadership development programs.

DeleteGreat analysis Steven. Given the fact that class size of Fuqua is around 50% the size of Harvard, I was surprised that Fuqua pretty much matched Harvard (outperformed it in certain cases) in the healthcare sector.

ReplyDeleteIts interesting to note that in 2013, the number of MBAs hired by healthcare sector decreased across schools. Any thoughts on what caused this pattern?

It'd be great if you can share a few details on the leadership development programs like total number of pharma/biotech companies having such programs, number of fuqua candidates hired by these programs etc.(Tried looking for that information. I couldn't find a comprehensive source. I was wondering if Fuqua career office had that information). Also, curious to know how the healthcare hiring at Fuqua is being benefited by the Research triangle. Do the mid-size, small size biotech/pharma companies at Research triangle hire candidates from Fuqua?

As always, thanks for sharing all this information :)

Hi Sathya, as always thank you for your comments.Here are my responses:

ReplyDelete1) Great observation for 2013. A couple of reasons may account for this. Since I pulled the data in Dec 2013, some of the schools may not have included folks who got their jobs a few months after graduation. In addition, I am not sure the differences are significant, since only 3 years worth of data are displayed here. There may just be some natural fluctuations from year to year. Again, the data isn't clean since it is self reported, and reporting criteria from the same school may differ from year to year. Each year's class composition is also different, so you'd expect ups and downs given people's diverse goals.

2) I had trouble finding this when I applied as well. My recommendation would be to go on LinkedIn and do a search of "school" and "company" and select the "currently employed there" option. Usually recent grads in rotational programs will put down the program's name on their job title, such as ECLDP for J&J or CRDP for Genentech. This'll take some time, but other than contacting the school this information will be difficult to find.

3) Some local RTP mid-sized firms recruit at Fuqua, including tech, biotech, consulting. Larger local companies like Biogen, GSK, Quintiles, BD also have had Fuqua interns/full time hires. In my view, RTP has a lot of early stage activity and does not have the mature healthcare startup environment as say Cambridge or South San Francisco. Early stage companies are more keen on hiring interns, as full time MBA talent is quite expensive to obtain and startups need to be efficient. With that said, keep in mind that you can do off campus recruiting at Fuqua, and many have been successful in doing so. In sum, RTP is on par in terms of startup internship recruiting, whereas other hubs would be better for startup fulltime recruiting. Let me know if this makes sense.

Just to add on to #3. This comment was based on my extremely limited effort in recruiting for startups in general for the summer. I was more focused on recruiting for pharma and getting the "big company" experience. I've drove around RTP and saw quite a few mid-sized biotechs. If you were to really immerse yourself in the biotech startup scene, I'm sure there are many opportunities that I am missing.

DeleteHi Steven, Why have you not included Kenan-Flagler in the above comparison? I saw its employment statistics and found that it has a great presence in healthcare MBA.

ReplyDeleteGreat point. I just checked Kenan-Flagler's career stats for the Class of 2014, and 13% of the class went into health care. That's about 36 folks each year. Will include UNC in my updated post for later this year. Thanks so much for the heads up!

DeleteThanks Steven! Im on the road to doing my mba research and like you I am currently a research associate in a biotech firm trying to transition into business development. Your articles definitely help in narrowing down my target schools.

ReplyDeleteYou're welcome! Glad to know that it has helped. I plan to update it once schools have their class of 2015 data available.

DeleteIf Congress really wants to use its legislative powers to make a difference on the fraud problem they must think outside-the-box of what has already been done in some form or fashion. wholesale gym equipment

ReplyDeleteThe human and social variables are extremely transcendent determinants in any general public or network. Article

ReplyDeleteThis implies, an individual is unhealthy, sick and diseased as long as there exists a deficiency in his/her body, soul, and spirit condition.venus factor reviews

ReplyDeleteI am very much pleased with the contents you have mentioned. I wanted to thank you for this great article. tryvexan

ReplyDeleteIt is an exceptionally expansive field and the strategies are assorted in their philosophies which can join or construct themselves in light of conventional solution, people information, otherworldly convictions or recently planned ways to deal with recuperating.

ReplyDeletehgh injections

We need to spend some effort in understanding health care and sorting out how we think about it. Properly armed we can more intelligently determine whether certain health care proposals might solve or worsen some of these problems. here

ReplyDeleteReferences - Paul, B., n.d. Test RX Research: Benefits, Side Effects & Guide! [WWW Document]. Testosteroneofficial.com ie. Testosterone Official. URL https://testosteroneofficial.com/reviews/test-rx/ (accessed 10.21.18).

ReplyDeleteI read that Post and got it fine and informative. moringa olifeira supefood

ReplyDeleteThanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise, would you mind updating your blog with extra information? It is extremely helpful for me. reviewswell.com

ReplyDeleteThis leads to the next thing where you should check if the product is up to the necessary standard. natural remedy for panic

ReplyDeleteThis is a smart blog. I mean it. You have so much knowledge about this issue, and so much passion. You also know how to make people rally behind it, obviously from the responses. banana benefits for men

ReplyDeleteMental health problems can lead to school failure, alcohol or other drug abuse, family discord, violence, or even suicide.help now

ReplyDeleteThis is an amazing website.http://www.andheriescortservices.in/andheri-call-girls.html I am very happy in joining this websiteSoftware House in Hyderabad

ReplyDeleteHiring a mental health therapist can be a daunting task especially if you've never engaged efforts to hire one. There are quite a number of things you need to determine so as to make the right choice. First and foremost you need to identify why you need a therapist; listing down all your needs in a piece of paper can aid in deciding which therapist to hire. There are quite a number of places you can visit to get good information about hiring mental therapist; one of the most preferred avenues by most people is the internet. Mental health therapist displays information about their expertise on their website homepage. Finding such homepage is quite easy; all CBD for anxiety and depression need to do is visit your favorite internet search engine and affect a keyword search on mental health therapist.

ReplyDeleteThanks for sharing this quality information with us. I really enjoyed reading. Will surely going to share this URL with my friends.

ReplyDeleteseat cushion

Thank you for such a well written article. It’s full of insightful information and entertaining descriptions. Your point of view is the best among many. Best place to but viagra online

ReplyDeleteIt is perfect time to make some plans for the future and it is time to be happy. I’ve read this post and if I could I desire to suggest you few interesting things or tips. Perhaps you could write next articles referring to this article. I want to read more things about it! Bursaries

ReplyDeleteThe holistic approach includes cbd wax body and spirit techniques that can be integrated with conventional treatment.

ReplyDeleteExcellent post. I was always checking this blog, and I’m impressed! Extremely useful info specially the last part, I care for such information a lot. I was exploring this particular info for a long time. Thanks to this blog my exploration has ended. https://noan.net/kak-da-otslabna

ReplyDeleteVery interesting and informative

ReplyDeleteHappy Weekend Messages

like it

Good Morning Images HD

"Hey guys, I just published this article 40 Awesome Nootropic Blogs, so wanted to share a short-and sweet version here.

ReplyDeleteToday, we’re going to take a look at the fascinating world of nootropic blogs, highlighting the best of the best, so you don’t have to look anywhere else.

In short, we’ve done the hard work for you; shifting our way through hundreds and hundreds of nootropics blogs, filtering them down through our strict guidelines and benchmarks of quality, content, and consistency, until only 40 exclusive blogs remained.

The nootropics industry is one that has progressively, yet rapidly, taken off around the world and has no signs of slowing down.

The science of biohacking and cognitive enhancement has never been more popular and the more people that are introduced this world, the more information there is to learn and the more we have to process.

With this in mind, there’s no.............. Continue Reading http://www.blackburndistributions.com/blog/top-40-nootropic-blogs/"

Thanks for the reponse. I’ll put this information to good use. Cockroach Pest Control Abu Dhabi

ReplyDeleteI'm really impressed about the info you provide in your articles. If you want to invest in suits and be stress-free, then you should shake hands with us. We are providing great clothing in the most reasonable price range that you wouldn’t find anywhere else. Put your trust in us as your supplier since we are the prominent printed stickers uk You can rely on us for the clothing problems we assure you we will never let our customers down.

ReplyDeletePretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. 300 Hours Yoga TTC

ReplyDeletei really like this article please keep it up. net worth

ReplyDeleteYour articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up! Health

ReplyDeleteIt was wondering if I could use this write-up on my other website, I will link it back to your website though.Great Thanks. Health

ReplyDeleteThe current century Health List an era of technological innovation. The burgeoning growth of technology has an impact on all aspects of our lives. In the health care industry, technologies have always played a significant role in patient health care and professional relationships. Innovations in technologies have significantly changed the way interactions between physicians and patients are performed and have greatly improved health care providers' services.

ReplyDeleteYour articles are inventive. I am looking forward to reading the plethora of articles that you have linked here. Thumbs up! site

ReplyDeleteNice post! This is a very nice blog that I will definitively come back to more times this year! Thanks for informative post. Best Grip Strengthener For Rock Climbing

ReplyDeleteAttractive information on your blog, thank you for taking the time and share with us.

ReplyDeletecustom window cake boxes

Amazing insight you have on this, it’s nice to find a website the details so much information about different artists.

ReplyDeletecustom toy boxes

i never know the use of adobe shadow until i saw this post. thank you for this! this is very helpful. best moisturizer for 4c hair

ReplyDeleteWow, cool post. I'd like to write like this too - taking time and real hard work to make a great article... but I put things off too much and never seem to get started. Thanks though. diet

ReplyDeleteNice post, keep up with this interesting work. It really is good to know that this topic is being covered also on this web site so cheers for taking time to discuss this! Healthy lunch Ideas

ReplyDeleteI am certainly making the most of your site. You unquestionably have some extraordinary knowledge and incredible stories.

ReplyDeleteembossed stickers

Wow! Such an amazing and helpful post this is. I really really love it. It's so good and so awesome. I am just amazed. I hope that you continue to do your work like this in the future also

ReplyDeleteTransparent stickers

When your website or blog goes live for the first time, it is exciting. That is until you realize no one but you and your. systeme delivrance

ReplyDeleteThis blog website is pretty cool! How was it made ! footcare drill

ReplyDeleteAwesome information! I as of late ran over your online journal and have been perusing along. I thought I would leave my first 메이저토토사이트

ReplyDeleteremark. I don't recognize what to say with the exception of that I have.

This is such an extraordinary asset, to the point that you are giving and you give it away for nothing.I adore seeing sites that 정보이용료 comprehend the benefit of giving a quality asset to free. It is the old what circumvents comes around schedule.

ReplyDeleteMuch obliged to you again for all the learning you distribute,Good post. I was exceptionally intrigued by the article, it's entirely rousing I ought to concede. I like going by you site 안전놀이터 since I generally run over fascinating articles like this one.Great Job, I enormously acknowledge that.Do Keep sharing! Respects,

ReplyDeleteimproving your health care quality by decreasing the errors and assuring to have exact and accurate information of your health by your health care providers on time.pill that boosts sexual performance

ReplyDeleteIts a great pleasure reading your post.Its full of information I am looking for and I love to post a comment that "The content of your post is awesome" Great work. thoatvidiadem.net/

ReplyDeleteHello I am so delighted I located your blog, I really located you by mistake, while I was watching on google for something else, Anyways I am here now and could just like to say thank for a tremendous post and a all round entertaining website. Please do keep up the great work. Find out now

ReplyDeleteI would like to thank you for the efforts you have made in writing this article. I am hoping the same best work from you in the future as well. Thanks... thoatvidiadem.net

ReplyDeleteA debt of gratitude is in order for your data, it was truly exceptionally helpfull.Greetings! A debt of gratitude is in order for the colossal data you havr gave! You have artificial turf installers austin touched on crucuial focuses!

ReplyDeletecustom invitation boxes are printed packaging for your products. custom invitation packaging is designed with logo and your specification. custom invitation packaging boxes are available at wholesale rates. custom invitation box packaging is inspiring packaging solution for your product. Get custom printed invitation boxes at wholesale rate with free shipping cost all across the United States and Canada.

ReplyDeletePkvpoker situs pkv games judi pkv poker online resmi terpercaya indonesia terbaik di permainan dominoqq atau domino99, bandarq dan sakong online 24 jam deposit.

ReplyDeleteWigopoker agen judi idn poker terpercaya online deposit via pulsa telkomsel, dominoqq terpercaya, situs idn poker terbaik dengan minimal deposit 25k.

ReplyDeleteWonderful article, thanks for putting this together! This is obviously one great post. Thanks for the valuable information and insights you have so provided here. https://ibaohiem.vn/bao-hiem-bao-viet-an-gia-bieu-phi-va-quyen-loi/#can-biet

ReplyDeleteFine information, many thanks to the author. It is puzzling to me now, but in general, the usefulness and importance is overwhelming. Very much thanks again and best of luck!

ReplyDeletenew birthday wishes

Custom Packaging Boxes

I truly welcome this superb post that you have accommodated us. I guarantee this would be valuable for the Safe mail order oxycodone vast majority of the general population.

ReplyDeleteI have read all the comments and suggestions posted by the visitors for this article are very fine,We will wait for your next article so only.Thanks! transferencia en psicologia

ReplyDelete*Affordability. There're significantly less expensive and you could promptly get them without spending excessively.

ReplyDeletehbnaturals

Do you need and want to remain youthful and excellent even in mature age? Your health and beauty is in your hands. Collagen Rich Foods

ReplyDeleteThis is my first time visit to your blog and I am very interested in the articles that you serve. Provide enough knowledge for me. Thank you for sharing useful and don't forget, keep sharing useful info: podiatry drill bits

ReplyDeleteThank you so much for the post you do. I like your post and all you share with us is up to date and quite informative, i would like to bookmark the page so i can come here again to read you, as you have done a wonderful job. school photographer

ReplyDeleteI like your post. It is good to see you verbalize from the heart and clarity on this important subject can be easily observed... Should I wear back brace while sitting

ReplyDeleteCheck the site of the Agency for Health Care approach and Research at www.ahcpr.gov and discover the appropriate responses.link

ReplyDeleteAnd that's what this is all about, health and living, to do things the right way. You will certainly function properly and healthfully as well. So, are you including all of these in your life? I hope so.buy bee nuc online

ReplyDeleteCigarette boxes are used for packaging and branding different kinds of cigarettes. The quality of Empty Cigarette boxes is critical for the acceptance or rejection of a tobacco label. Designing an Luxury cigarette boxes requires professional experience. i Custom Boxes.com is a premium printing press that has been gratifying the packaging needs of a cohort of businesses across the world. The dedication to deliver the best has earned us commendation from thousands of satisfied customers.

ReplyDeleteCardboard box with handle

boxes for bath bomb

Fries box

Custom boxes

Lipstick boxes

French fry box

This is an incredible 100 usd to gbp moving article.I am essentially satisfied with your great work.You put truly extremely accommodating data...

ReplyDeleteI wouldn't propose that straight individuals should peruse gay erotica. If you don't mind leave those for the expected perusers. Brian Holm lawyer california

ReplyDeleteAs more and more health problems continue to ravage our world, there's wisdom in taking your health and well-being into your own hands rather than relying on what government and physicians can offer.buy clonazepam no prescription

ReplyDeletePhysical, emotional, financial and all other kinds of stress will be the norm if we are not actively managing our health. All we have to do is reverse that model by stressing health.MYLE Pods Dubai

ReplyDeleteCannabis Chocolate Boxes are uniquely made to cover and contain Cannabis Chocolate Boxes.

ReplyDeleteThe study of the study of disease transmission utilizes different techniques and ways to deal with investigate, examine, distinguish and build up the reason for malady as against upkeep of wellbeing in the person, in the network and in a land region.

ReplyDeleteNatural probiotics

Awesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! https://www.dailygoal.gr/winsol-winstrol/

ReplyDeleteThis is really a nice and informative, containing all information and also has a great impact on the new technology. Thanks for sharing it, aurora-chiropractor

ReplyDeletei never know the use of adobe shadow until i saw this post. thank you for this! this is very helpful. best banjo musicians

ReplyDeleteThanks for sharing us. Vanquish ME in woodlands

ReplyDeleteThank for your post. I read that Post very carefully and got it fine and informative. kayak boat it a very useful article.

ReplyDeleteThis is truly a decent and educational, containing all data furthermore greatly affects the new innovation. A debt of gratitude is in order for sharing it,

ReplyDeleteMillion Mask March

ReplyDeleteThe data you have posted is exceptionally valuable. The locales you have alluded was great. A debt of gratitude is in order for sharing..

Million Mask March

This is truly a decent and enlightening, containing all data furthermore greatly affects the new innovation. A debt of gratitude is in order for sharing it

ReplyDeleteAnonymous Million Mask March

It was a very good post indeed. I thoroughly enjoyed reading it in my lunch time. Will surely come and visit this blog more often. Thanks for sharing.Disney

ReplyDeleteAutonomy means self-determination and the right to self-determination over their lives. Autonomy and independence are fundamental and health adversely affected if options are missing.cbd gummies

ReplyDeleteHello there, just became alert to your blog through Google, and found that it’s truly informative. I am gonna watch out for brussels. I will be grateful if you continue this in future. Many people will be benefited from your writing. Cheers! solidworks 2018 premium

ReplyDeleteLove to read it,Waiting For More new Update and I Already Read your Recent Post its Great Thanks. acupressure

ReplyDeleteThis is an incredible moving article.I am essentially satisfied with your great work.You put DNA Testing near me truly extremely accommodating data...

ReplyDeleteThe coming up of the exceptionally strong oil concentrates of cannabis, CBD rich non inebriating items and profoundly creative and smokeless frameworks of conveyance have changed the remedial zone.CBD oil

ReplyDeleteFor mental issue like tension or gloom, start off with an underlying portion of 2 mg for each day. Increment by 2 mg consistently until you notice positive outcomes.

ReplyDeleteCBD

Thanks for picking out the time to discuss this, I feel great about

ReplyDeleteaccommodation south

gippsland

I am no longer sure where you're getting your information, however great topic. I must spend some time finding out much more or understanding more. Thank you for fantastic information I used to be on the lookout for this info for my mission.

ReplyDeleteWedding

The when Someone said a blog, I am hoping that this doesnt disappoint me approximately this place. Come on, man, Yes, it was my choice to read, but I just thought youd have something fascinating to mention. All I hear is a bunch of whining about something you could fix in the event you werent too busy interested in attention. Autocad | CheapSoftwareDownload

ReplyDeleteyour content is amazing as always!Thanks for such a great post.I'll give you a link to my site.space ring

ReplyDeleteI look this blog is very carefull. This blog is so effected for everyone.And this post is really awesome.

ReplyDeletevideos

2020 Best Expert Adviser with over 1600+ Live accounts on Forex.

ReplyDeleteMaking 214% Daily profits

Xautobot is a outcome of 10 years of Experience in Forex trading

which helps traders to trade stress less and make money while

sleeping.orex automated trading

As a result, the term "sexual health" can be misused to express approval or disapproval of specific behaviours or individuals under what may seem to be "medical truth".supplements

ReplyDeleteI might want to thank you for the endeavors you have made in composing this article. I am trusting the same best work from you later on too.. CBD gummies for sale

ReplyDeleteOur Computer Office chair for someone who loves to play video games. Studying or working. When you go to the markt you will find out the deals as they run quite expensive if you want find out a multi-function chair as ours.original price=$199.99--Discounted price=$139.99.YSZLA6WU(discount code).Computer Office Chair

ReplyDeleteYou may know about the other sites, which provides the facilities for watching anime actions

ReplyDeleteGoGoanime

That’s why they try to get that site, which provides the facility of their different languages. If you also want to get your favorite language site, then you have to get the Kissanime.

ReplyDeleteKissanime

3D SWERTRES RESULT – Philippine Charity Sweepstakes Office holds Suertres 3D Lotto draws daily at 11am, 4pm and 9PM. This page contains the latest PCSO Swertres result today, hearing, 3D result and tips. The numbers above comprises the Swertres Result for the morning

ReplyDeleteswertres result

Even though we recommend getting rust converters to deal with the unwanted rusted on your vehicles and appliances, for some it’s just not enough.

ReplyDeletesafe to buy a rust remover

While consumers search for affordable health insurance, they have price in their mind as the top priority. A general conception among the consumers is that cheap health plans should not be costly-the cheapest health plan available in the market is their target.CBD

ReplyDeleteI am a MSc. qualified nutritionist and author, with over 20 years

ReplyDeleteexperience in the health, nutrition and fitness industry. I am

passionate about health, nutrition, and positive mental health. And,

I am passionate about helping people lose weight, address their diet

concerns, and achieve their nutrition and health goals.nutritionist

Great job for publishing such a beneficial web site. Your web log isn’t only useful but it is additionally really creative too. Modafinil Buy

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteOnce treatment is undertaken, however, the home health provider is usually obliged to continue providing services until the patient has had a reasonable opportunity to obtain a substitute provider. The same principles apply to failure of a patient to pay for the services or equipment provided.http://brainpop4.com/some-of-the-best-benefits-of-ursolic-acid/

ReplyDeleteI truly welcome this superb post that you have accommodated us. I guarantee this would be valuable for the vast majority of the general population.

ReplyDeletejob posting site

This is truly a decent and enlightening, containing all data furthermore greatly affects the new innovation. A debt of gratitude is job posting in order for sharing it

ReplyDeletegreat work.

ReplyDeletelotto draw history

Thank you for sharing informative article

ReplyDeleteComputer desk

Thank you for sharing information

ReplyDelete먹튀검증

really impressed about the info you provide in your articles. If you want to invest in suits and be stress-free,monocytes then you should shake hands with us. We are providing great clothing in the most reasonable price range that you wouldn’t find anywhere else.

ReplyDeletegreat post.

ReplyDelete먹튀검증

Custom Packaging Boxes

ReplyDeleteHealey Packaging is one of the best Pakistan based custom packaging boxes printing company which is involved in producing every brand of custom packaging boxes and custom boxes with logo.

This comment has been removed by the author.

ReplyDeletehttps://noan.net/dieti/razdelno-hranene We have sell some products of different custom boxes.it is very useful and very low price please visits this site thanks and please share this post with your friends.

ReplyDeletenoan.net razdelno hranene I wanted to thank you for this excellent read!! I definitely loved every little bit of it. I have you bookmarked your site to check out the new stuff you post.

ReplyDeleteI have read all the comments and suggestions posted by the visitors for this article are very fine, Digital M We will wait for your next article so only.Thanks!

ReplyDeleteYes i am totally agreed with this article and i just want say that this article is very nice and very informative article.I will make sure to be reading your blog more. You made a good point but I can't help but wonder, what about the other side? !!!!!!Thanks Arcoxia rezeptfrei

ReplyDeleteA debt of gratitude is in order for your data, it was truly exceptionally helpfull.Greetings! A debt of gratitudeibrahim is in order for the colossal data you havr gave! You have

ReplyDeleteHello, this weekend is good for me, since this time i am reading this enormous informative article here at my home. sos sciatique pdf gratuit

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! mike geary tout sur les abdominaux

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! livre programme de reconstruction capillaire

ReplyDeletenice bLog! its interesting. thank you for sharing.... view more

ReplyDeletenice bLog! its interesting. thank you for sharing.... arnaque revolut

ReplyDeleteThis is my first time i visit here and I found so many interesting stuff in your blog especially it's discussion, thank you. la diete deux semaines

ReplyDeleteTo manage true population health - that is, the health of a community - hospitals and health systems must partner with a broad spectrum of stakeholders who share ownership for improving health in our communities."CBD gummies

ReplyDeleteWhen your website or blog goes live for the first time, it is exciting. That is until you realize no one but you and your. https://titangel.international/el/greece/

ReplyDeleteAll of our packaging boxes have been great success and as far as it is about cardboard cigarette boxes, they are number one box in a lot of ways.

ReplyDeleteCustom Boxes Wholesale,

Paper Cigarette Boxes,

Bath bomb packaging,

Pre Roll Packaging,

Cardboard Cigarette boxes,

Blank Cigarette Boxes,

custom burger boxes

GOOD SHARING

ReplyDelete토토사이트

This comment has been removed by the author.

ReplyDeleteThe data you have posted is extremely valuable. The locales you have alluded was great. A debt of gratitude is in order for sharing... thetrever

ReplyDeleteI am impressed. I don't think Ive met anyone who knows as much about this subject as you do. You are truly well informed and very intelligent. You wrote something that people could understand and made the subject intriguing for everyone. Really, great blog you have got here. Learn more

ReplyDeleteYou make so many great points here that I read your article a couple of times. Your views are in accordance with my own for the most part. This is great content for your readers. berberine avis

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! comment faire baisser sa glycemie avant une prise de sang

ReplyDeleteThis is an incredible instagram panel

ReplyDeletemoving article.I am essentially satisfied with your great work.You put truly extremely accommodating data...

A debt of gratitudeStahlwandpool is in order for offering pleasant data to us. i like your post and all you impart to us is uptodate and entirely useful, i might want to bookmark the page so i can come here again to peruse you, as you have made a superb showing.

ReplyDeleteThis is truly a decent and enlightening, containing all data furthermore greatly affects the new innovation. A debt of gratitude is in order for sharing it the tre ver

ReplyDeleteDandelions are a spring and a fall producer, and you can utilize this natural herbicide either time, or both. Continuously get familiar with your irritation plant's growing time, and apply the common weed control at that point. Weed Seeda

ReplyDeletenice post.

ReplyDeletelaisvu ranku iranga

i never know the use of adobe shadow until i saw this post. thank you for this! this is very helpful. vloveyoni

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! ULV SPRAYER

ReplyDeleteWow! Such an amazing and helpful post this is. I really really love it. It's so good and so awesome. I am just amazed. I hope that you continue to do your work like this in the future also nightgowns canada

ReplyDeleteThis article is an appealing wealth of informative data that is interesting and well-written. I commend your hard work on this and thank you for this information. You’ve got what it takes to get attention. Grass fed ghee

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! clenbuterol achat

ReplyDeleteGreat job for publishing such a beneficial web site. Your web log isn’t only useful but it is additionally really creative too. Dentist Mequon WI

ReplyDeleteTrying to find the best diet pill may seem like an impossible task, especially with the multitude of diet pills available for purchase john barban resurge

ReplyDeleteThe best explanation about this topic in this part of the universe. Thank you. wholesale packaging boxes

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! Order Percocet 10mg Online

ReplyDeleteWhen you use a genuine service, you will be able to provide instructions, share materials and choose the formatting style. Daniel Negreanu MasterClass Review

ReplyDeletePretty good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. how to lose weight

ReplyDeleteIf you are looking for more information about flat rate locksmith Las Vegas check that right away. Buy 4-aco-dmt online

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! 2040年問題 医療

ReplyDeleteWow, cool post. I'd like to write like this too - taking time and real hard work to make a great article... but I put things off too much and never seem to get started. Thanks though. دواء لقوة الانتصاب

ReplyDeleteThe post is instagram panel composed in extremely a decent way and it contains numerous helpful data for me.

ReplyDeleteHello, this weekend is good for me, since this time i am reading this enormous informative article here at my home. 花蓮賞鯨

ReplyDeleteHi

ReplyDeletewe are securepharmacare we provide you medicines online in usa

buy oxycodone online in usa overnight delivery

buy hydrocodne online in usa overnight delivery

Awesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! buy painkillers online

ReplyDeleteYes i am totally agreed with this article and i just want say that this article is very nice and very informative article.I will make sure to be reading your blog more. You made a good point but I can't help but wonder, what about the other side? !!!!!!Thanks CBD Edibles

ReplyDeleteBeing healthy is so important to the quality of our lives. We should celebrate the life we have and that means taking the very best care of ourselves. 남성중점치료병원

ReplyDeleteThank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our. Jet Setter

ReplyDeleteIf a affected person turns into injured due to clinical negligence, that affected person might report a lawsuit claiming medical malpractice.buy cialis with dapoxetine

ReplyDeleteThank you because you have been willing to share information with us. we will always appreciate all you have done here because I know you are very concerned with our. Best Omega 3 Fatty Acids

ReplyDeleteLoved reading your blog. I like the significant data you give in your articles. I am impressed by the manner in which you introduced your perspectives and appreciating the time and exertion you put into your blog. Much thanks to you for such a great amount for sharing this sort of information.

ReplyDeleteVisit us for online visiting card printing.

Greetings! A debt of ducted air conditioning Sydney gratitude is in order for the colossal data you havr gave! You have touched on crucuial focuses!

ReplyDeleteGreetings! A debt ducted air conditioning Sydney of gratitude is in order for the colossal data you havr gave! You have touched on crucuial focuses!

ReplyDeleteWow! Such an amazing and helpful post this is. I really really love it. It's so good and so awesome. I am just amazed. I hope that you continue to do your work like this in the future also. bible health

ReplyDeleteLoved reading your blog. I like the significant data you give in your articles. I am impressed by the manner in which you introduced your perspectives and appreciating the time and exertion you put into your blog. Much thanks to you for such a great amount for sharing this sort of information.

ReplyDeleteVisit us for online banners printing.

Hi

ReplyDeletewe are wecareyourmeds we provide you medicines online in usa

hydrocodone acetamin 5-325 online usa

buy oxycodone 80mg online

Supplementstest is one of the most trusted online pharmacy, in dispensing quality medications. At Supplementstest, we help you look after your own health effortlessly as well as take care of your loved ones wherever they may reside.

ReplyDeleteBest place to buy Tramadol online in USA

Best place to buy Ambien online in USA

Best place to buy Xanax online in USA

Best place to buy Valium online in USA

Hello, this weekend is good for me, since this time i am reading this enormous informative article here at my home. https://alvenda.com/phenq-walmart/

ReplyDeleteYour blog is very informative and interesting than you for sharing with us.Custom Boxes Wholesale

ReplyDeleteYou make so many great points here that I read your article a couple of times. Your views are in accordance with my own for the most part. office com setup

ReplyDeleteThis was a fantastic, positive and helpfuloffice com setup

ReplyDeleteAwesome article, it was exceptionally helpful! I simply began in this and I'm becoming more acquainted with it better! Cheers, keep doing awesome! Benefits of CBD Oil for Cerebral Palsy

ReplyDeleteThe WHO definition of health is unrealistic (nobody, not even the most devout wellite, enjoys "complete physical, mental and social well-being," at least not every day). Most think of health in far less exalted ways. hasta yatağı kiralama

ReplyDeleteBy going on extreme low calorie diets, your body will go into starvation mode, because it doesn't know when it will get more nutrients! By eating so few calories, your body slows down its calorie burning processes and starts hoarding fat. weight loss and

ReplyDeleteGet wide range of Cardboard cigarette boxes solutions on wholesale prices at icustomboxes. We provide Cardboard cigarette packaging in USA. The right design and quality of Cardboard Cigarette Boxes can make your brand stand out from all the others. If you’re a new brand in the market, you’ll need an extraordinary design that we can provide to urge people’s attraction.

ReplyDeleteCardboard cigarette boxes

Custom Foam Inserts

Noodles boxes

Preroll box

I like the valuable info you provide in your articles. I will bookmark your blog and check again here frequently. I am quite certain I will learn many new stuffs right here! Good luck for the next!

ReplyDeletefactory outlets market of clothing brands in Lahore

I like the valuable info you provide in your articles. I will bookmark your blog and check again here frequently. I am quite certain I will learn many new stuffs right here! Good luck for the next!

ReplyDeleteUfone Mera Shahar Offer

The data you have posted is extremely valuable. Cheap PCB Prototype The locales you have alluded was great. A debt of gratitude is in order for sharing...

ReplyDeleteI'm glad to see the great detail here!. BROWNIES AND BARS

ReplyDeleteSuperbbb! very impressive and I get many ideas from this article. It is very helpful for me

ReplyDeleteCandle Packaging Boxes

I am continually amazed by the amount of information available on this subject. What you presented was well researched and well worded in order to get your stand on this across to all your readers. импотентност

ReplyDeleteThanks for sharing us. блистери

ReplyDeleteWow! Such an amazing and helpful post this is. I really really love it. It's so good and so awesome. I am just amazed. I hope that you continue to do your work like this in the future also Liquid Honey Tincture 250MG

ReplyDeletehttps://justcbdstore.com/product/full-spectrum-tincture/ This is very educational content and written well for a change. It's nice to see that some people still understand how to write a quality post!

ReplyDeleteThis is truly a decent and enlightening,Deratisation containing all data furthermore greatly affects the new innovation. A debt of gratitude is in order for sharing it

ReplyDeleteGreat things you’ve always shared with us. Just keep writing this kind of posts.The time which was wasted in traveling for tuition now it can be used for studies.Thanks CDB Oil FAQs

ReplyDeleteA very excellent blog post. I am thankful for your blog post. I have found a lot of approaches after visiting your post. Soap boxes

ReplyDeleteSuch a great post I like it very much to keep it up..

ReplyDeletecolourful display boxes

This comment has been removed by the author.

ReplyDeleteGreat post I like it very much keep it up.

ReplyDeletecustom jewelry packaging

nice sharing

ReplyDeletePaginas de venta en republica dominicana